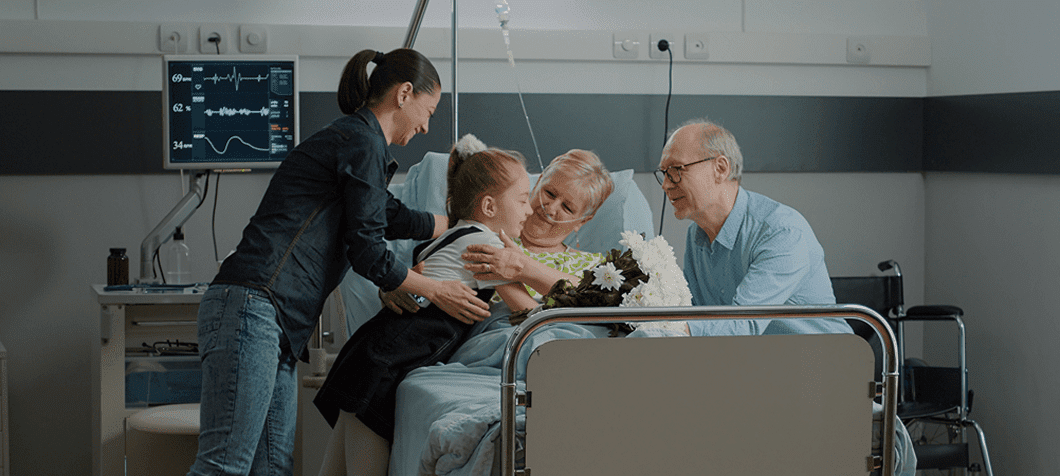

When accidents, illnesses, or hospital stays disrupt your life, supplemental insurance steps in to ease the financial strain. It pays you directly, so you can use the money where it matters most, from medical bills to everyday expenses. Whether you're recovering from an injury, facing a serious diagnosis, or planning ahead for end-of-life costs, this extra layer of coverage helps you stay afloat during life’s most challenging moments.

Because when life feels unfair, your insurance should feel like support, not another worry. It should show up with compassion, clarity, and real help, exactly when you need it most.

Families facing high medical costs

Self-Employed or gig workers

Savers wanting to avoid financial setbacks

Seniors planning for end-of-life expenses

Cash Payouts to You: Receive money directly, giving you the freedom to use it for medical bills, rent, or daily Coverage for Critical Events

Coverage for Critical Events: Get financial protection for serious illnesses like cancer, stroke, or heart attack.

Added Support for Hospital Stays: Helps cover the costs of overnight admissions, treatments, and recovery time.

Income Protection During Recovery: Short-term disability benefits help replace lost income when you can’t work due to injury or illness.

Copyright © 2025. All Rights Reserved. Designed By TheBrandChimp